Investing in real estate can be a lucrative endeavor, but it’s essential to have a solid understanding of the market and a clear plan before diving in. For those looking to flip properties, an Investor Brief Flip Real Estate Template can provide a structured framework to guide their investment decisions and communicate their strategy to potential investors.

Understanding the Template

An Investor Brief Flip Real Estate Template typically includes several key sections that outline the investment opportunity, market analysis, deal structure, financial projections, and exit strategy. The template standardizes the information presented, making it easier for investors to evaluate and compare different investment proposals.

By leveraging this template, investors can gain insights into the property’s potential return on investment, the estimated time frame for the flip, and the risks associated with the project. The template provides a comprehensive overview of the investment and serves as a communication tool to convey the investor’s vision and strategy to interested parties.

Sections of the Template

Investment Overview

This section provides a brief description of the property, its location, and its target market. It should highlight the property’s unique features and potential for appreciation.

Market Analysis

The market analysis section presents data on the local real estate market, including comparable sales, rental rates, and vacancy rates. This information helps investors understand the potential demand for the property and assess the competition.

Deal Structure

The deal structure outlines the terms of the investment, including the purchase price, closing costs, financing arrangements, and profit-sharing terms. This section ensures that investors are fully aware of the financial aspects of the project.

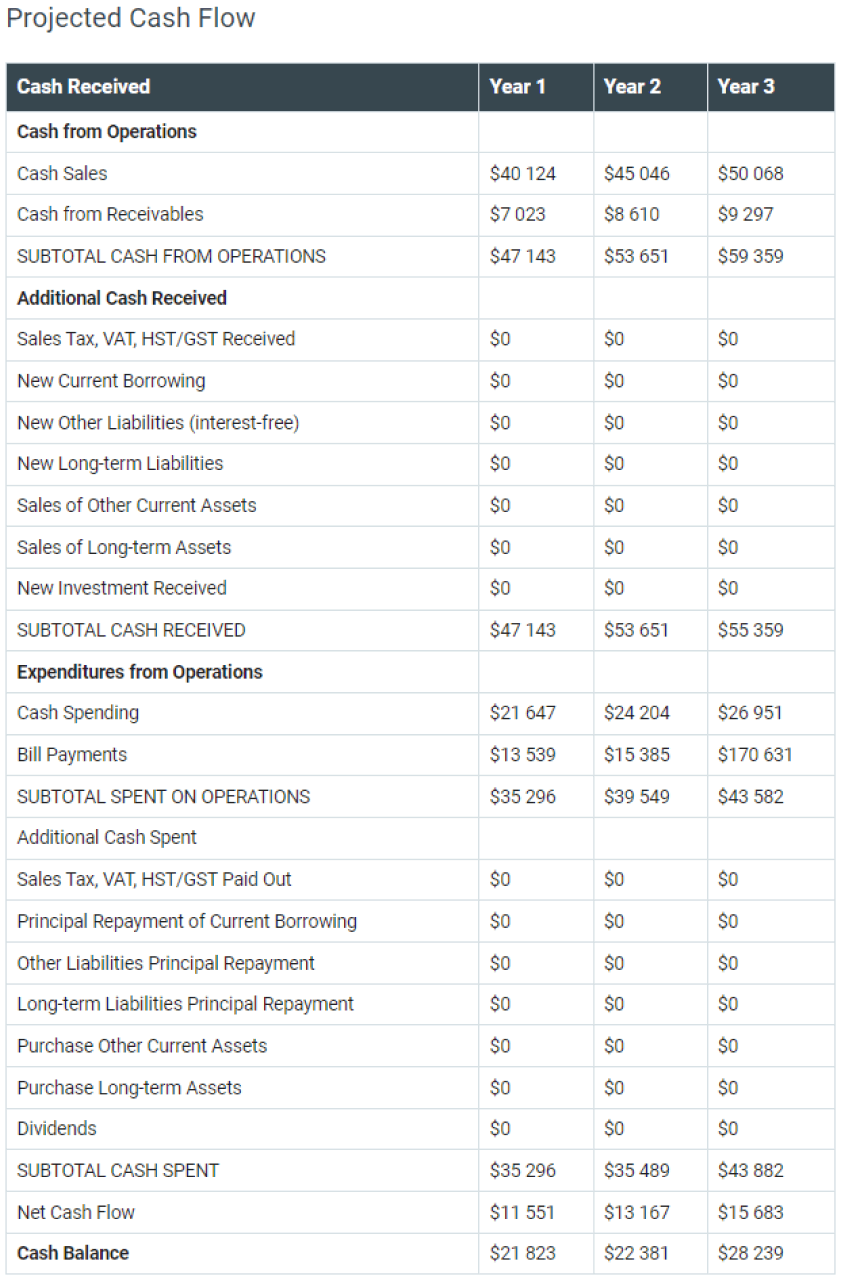

Financial Projections

The financial projections section presents a detailed analysis of the expected cash flow, expenses, and profitability of the flip. It helps investors estimate the potential return on investment and identify any areas of concern.

Exit Strategy

The exit strategy section describes the investor’s plan for selling the property, including the estimated timeframe and potential sales price. This section provides investors with an understanding of the potential liquidity of the investment.

Conclusion

Using an Investor Brief Flip Real Estate Template is an effective way to communicate the investment opportunity, provide transparency to potential investors, and enhance the credibility of the project. By structuring the information in a standardized format, investors can easily compare different deals and make informed investment decisions.

Whether you’re a seasoned investor or just starting out, an Investor Brief Flip Real Estate Template can streamline the investment process and increase your chances of success in the competitive real estate market.