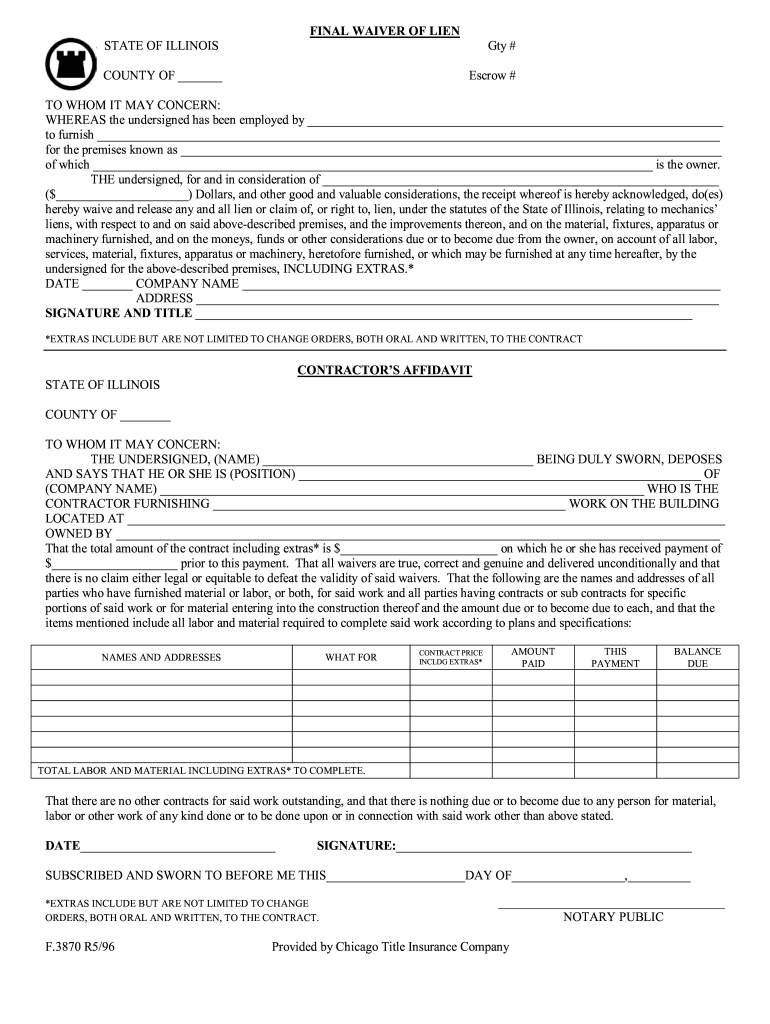

When it comes to real estate transactions, there are a lot of documents that need to be signed and exchanged. One of these documents is a lien waiver. A lien waiver is a legal document that releases a lien on a property. This means that the person or company that is owed money on the property agrees to give up their right to collect that money if the property is sold or refinanced.

If you’re selling or refinancing a property in Chicago, you’ll likely need to get a lien waiver from Chicago Title. Chicago Title is a title insurance company that insures the ownership of real estate. They will require a lien waiver before they can issue a title insurance policy.

What Is a Chicago Title Lien Waiver?

A Chicago Title lien waiver is a legal document that releases a lien on a property in Chicago. This means that the person or company that is owed money on the property agrees to give up their right to collect that money if the property is sold or refinanced.

Chicago Title lien waivers are typically used in real estate transactions. When a property is sold, the buyer’s lender will require a Chicago Title lien waiver before they can issue a loan. This is because the lender wants to make sure that there are no liens on the property that could prevent them from collecting their money if the buyer defaults on their loan.

Chicago Title lien waivers can also be used in refinancing transactions. When a homeowner refinances their mortgage, the new lender will require a Chicago Title lien waiver before they can issue a new loan. This is because the new lender wants to make sure that there are no liens on the property that could prevent them from collecting their money if the homeowner defaults on their loan.

If you’re selling or refinancing a property in Chicago, you’ll need to get a Chicago Title lien waiver from the person or company that is owed money on the property. You can typically get a lien waiver by contacting the lienholder and asking them to sign a lien waiver form.

How to Get a Chicago Title Lien Waiver

To get a Chicago Title lien waiver, you’ll need to contact the lienholder and ask them to sign a lien waiver form. The lienholder is the person or company that is owed money on the property. They may be a lender, a contractor, or a supplier.

Once you have contacted the lienholder, they will typically send you a lien waiver form. The lien waiver form will need to be signed by the lienholder and notarized. Once the lien waiver form is signed and notarized, you can submit it to Chicago Title. Chicago Title will then review the lien waiver form and issue a title insurance policy.

Getting a Chicago Title lien waiver can be a simple process. By following the steps outlined above, you can get a lien waiver quickly and easily.

Once you have a Chicago Title lien waiver, you can be confident that your property is free of liens. This will give you peace of mind and allow you to move forward with your real estate transaction.